Tax Return in Australia

Tax Return in Australia is a process by which all individuals who have legally worked in the country must file a tax return. This process involves reporting income earned during the tax year, as well as any applicable tax deductions or credits. The purpose is to ensure that tax obligations are met and appropriate payments are made to the Australian government.

When and why do I have to do it?

The tax year in Australia differs from the system used in Spain and other countries. It starts on July 1 and ends on June 30 of the following year. During this period, tax returns are required to be filed, which can be done from July 1 to October 31. If you choose to use a tax agent, the deadline may be extended a little longer.

It is important to remember that you will have to do the tax return in Australia if you have legally worked in Australia, either as an employee (using a Tax Identification Number, TFN) or as a self-employed person (using a Business Identification Number, ABN), or both. If your visa is for 6 months or more, you will be considered an Australian resident for tax purposes and therefore must file a tax return as a resident.

Do I have to submit it if I am a student?

Yes, if your course of study is 6 months (24 weeks) or longer, you will be considered a resident of Australia for tax purposes. This is good news, as if your income for the tax year is less than AUD 18,200, which is the non-taxable threshold, you could receive a refund of all the tax withheld and would not have to make any additional payments.

However, if you have exceeded the AUD 18,200 income amount, it is important to take advantage of all allowable deductions and expenses to reduce your tax liability. This may include work-related expenses such as uniforms or equipment required for your job.

These scales apply to individuals residing in Australia for tax purposes in the year 2022/23.

0 – $18,200 | Nil |

$18,201 – $45,000 | 19c for each $1 over $18,200 |

$45,001 – $120,000 | $5,092 plus 32.5c for each $1 over $45,000 |

$120,001 – $180,000 | $29,467 plus 37c for each $1 over $120,000 |

$180,001 and over | $51,667 plus 45c for each $1 over $180,000 |

How can I file my Tax Return?

There are several ways to complete your tax return in Australia

-

De forma autónoma, ingresando en la página web del gobierno a través de tu cuenta de inmigración. Allí podrás encontrar los formularios y seguir los pasos necesarios para presentar tu declaración de impuestos.

-

Visiting an Australian Taxation Office (ATO) office. You can visit an ATO office, where they will provide you with free assistance, especially if your income is less than AUD 50,000 and you have a Tax File Number (TFN).

-

With the help of a tax agent. You can hire the services of a tax agent who will guide and assist you throughout the entire process of filing your tax return.

Tax Return Deductions and Withholdings in Australia: What They Are and How They Affect You

Deductions

Deductions are expenses you have incurred and paid related to your work, whether as an employee or self-employed.

Para determinar las deducciones, generalmente puedes aplicar el sentido común. Sin embargo, si tienes dudas, es recomendable consultar a un experto en contabilidad y fiscalidad, como un contador de impuestos. Puedes encontrar información sobre las deducciones que puedes reclamar en el sitio web de la ATO.

There is also a deduction called the Medicare Levy, which applies to both Working and Holiday (W&H) visa holders and students. The Medicare Levy is a tax paid by Australian citizens who are covered by the public Medicare health system. However, students and W&H visa holders who have private health insurance are not required to pay it. So, if you have earned more than $22,980 AUD, you can deduct the 2% Medicare Levy.

Here You can find the document and information necessary to claim it.

Withholdings

Withholdings are amounts your employer deducts from each of your paychecks (calculated based on your weekly wage). These withholdings are considered prepaid taxes for your tax return.

This means that these withholdings will be taken into account when calculating whether you should receive a refund or pay additional tax on your tax return. If you have earned more than $18,200 AUD, a tax of 19TP3T will be applied to the dollars above that threshold. Any withholdings already made will be subtracted from the amount to be refunded or added to the amount to be paid depending on your tax situation.

How to do my own tax return in Australia

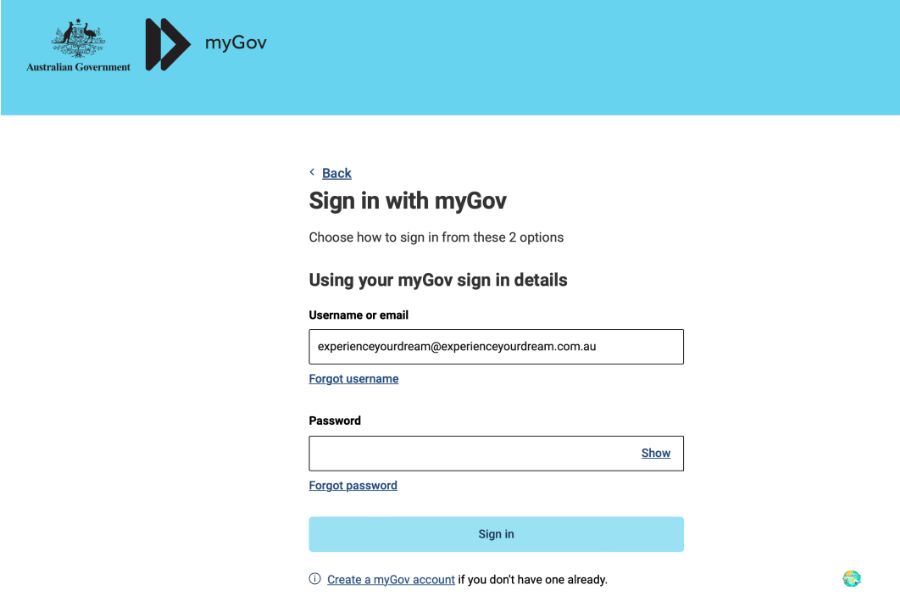

Step 1: MyGov account linked to the ATO

The first thing you must do to file the tax return in Australia is to open an account in MyGov and link it to the ATO.

In addition, in order to file your tax return in Australia, it is important that all your wages are marked as “tax ready”. This means that your employer has already filed the tax return corresponding to your income.

Recuerda que son los empleadores los responsables de cargar esta información en el sitio web de la Australian Taxation Office (ATO), por lo que no debes hacerlo tú mismo.

When you log into your account on the portal myGov, you will see that the option “tax ready”» will only appear once your employer has uploaded the necessary information. If it still does not appear, you will not be able to file your tax return, as the amounts may vary until your employer completes the data upload.

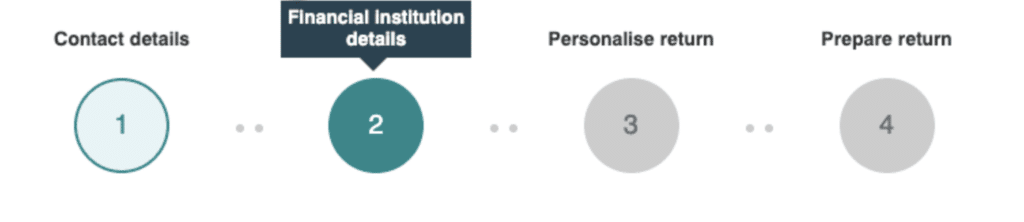

Step 2: Contact Details

In this step, you simply need to check that your contact details are correct. You do not need to fill in any additional information, as the details are already provided to the ATO. Therefore, you only need to Click “Next” without taking any further action.

Step 3: Financial Institution Details

In step 2, you simply need to review the bank account details. You do not need to fill out any additional information, just check that the details are correct. Once reviewed, you can Click “Next” without having to take any further action.

Step 4: Personalize Return

This step is to personalize your tax return by answering the ATO questions and confirming that the data reflected is correct.

After including and answering everything, do Click “next”.

Step 5: Prepare Return

This is where you should upload tax deductions, tax data and totals that you have earned through ABN or other means and that are not reflected in your tax return. Remember to request your Medicare Levy Exemption.

To finish it is done click on “calculate”, On the same page, the calculation of your tax return will be displayed.

At the bottom of the page, you will find a box that you must check to accept and “sign” the return with the personal data you entered at the beginning of your session. Finally, click on “Submit” (Lodge). By doing so, you will be agreeing to submit that tax return to the ATO.

Do I have to file a Tax Return even if I am not staying in Australia?

Yes, the law says that everyone who received income in Australia has the obligation to file a tax return in Australia.

When travelling to Australia, it is mandatory to comply with all of the country's tax laws. If you fail to comply with these laws, you may face fines or penalties for failing to declare your income. The penalty for failing to file your tax return by 31 October each year can range from $400 to $2,000 AUD.

Additionally, if you leave the country without filing a tax return in Australia and decide to return to Australia in the future, you may face problems when applying for a new visa.